Inside the global deleveraging

Ever since the world ran face-first into the credit crisis, the phrase "de-leveraging" has been on a lot of people's lips. It's considered both a short-term curse (it reduces consumer and business demand) but the long-term cure (once our books our balanced we can head back to the mall).

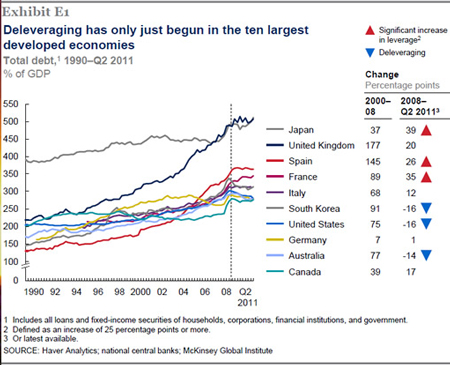

A new study from McKinsey surveys a number of countries whacked by the financial crisis to see which consumers have done the best job paring back their debt loads. The answer, as you can see from the chart (click it for a larger image), is that the U.S. has done quite well in this regard but in other major economies, a lot of work still remains. There is some encouraging news, though, as McKinsey notes:

The deleveraging processes in Sweden and Finland in the 1990s offer relevant lessons today. Both endured credit bubbles and collapses, followed by recession, debt reduction, and eventually a return to robust economic growth. Their experiences and other historical examples show two distinct phases of deleveraging. In the first phase, lasting several years, households, corporations, and financial institutions reduce debt significantly. While this happens, economic growth is negative or minimal and government debt rises. In the second phase of deleveraging, GDP growth rebounds and then government debt is gradually reduced over many years.

McKinsey says the U.S. is "most closely following the Nordic path" which is comprised of six critical factors: a stable banking system, a credible plan for long-term fiscal sustainability, structural reforms already in place, rising exports, rising private investment, a stabilized housing market.

I'm not sure if the U.S. has yet reached a credible plan for long-term fiscal sustainability (just the opposite) but there it is.

[Hat tip: Drezner]